Among the issues that CLB are handling is the area’s enormous inventory off unused land. To minimize so it surplus frequency, demolition was a serious strategy. “I have a casing stock that has been designed for a million somebody, and there are merely from the 365,100000 somebody today. Besides several areas, we’re however shedding people. There isn’t any sign one into the 5, 10, otherwise two decades we’re going to has actually a million individuals,” shows you Gus Frangos, president and you may general the advice from CLB. 21 Treatment is actually viable only when an industry can be found for those rehabilitated land. Incredibly important, the fresh new condition cannot afford in order to demolish every property one must be razed. 22

The rest forty per cent regarding house you to definitely CLB acquires is rehabilitated because of the land-bank, some one, or of the spouse communities. These rehabilitations is actually backed by programs offering incentives to have reple, into the , CLB married to your town of Euclid and also the Neighborhood Property Functions out-of Greater Cleveland to discharge the advantage And Mortgage Program, that gives Euclid homeowners that have around $ten,100 in two percent money for rehabilitation. 23 From HomeFront Pros Owning a home System, an effective airplane pilot program released in and you may financed which have $100,100000 on the Cuyahoga County Council’s Experts Qualities Financing, CLB offers qualified veterans discounts all the way to 20% out-of the cost of a land lender household and covers brand new closing can cost you. Like with the new land bank’s others that concentrate on personal homeowners, HomeFront makes it necessary that citizens contain the property as his or her primary quarters to own at least couple of years and you can rehabilitate the house or property for the conformity with land bank standards; at exactly the same time, they must was in fact utilized for at the very least during the last 12 months. twenty four Eventually, new land-bank deals with social service providers eg sober-living apps and refugee invention facilities to include their clients that have a location to alive.

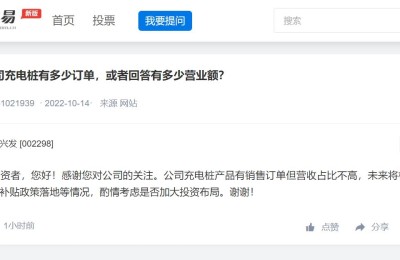

Demolitions is a life threatening a portion of the Cuyahoga Property Bank’s functions considering the plethora of empty and you may quit characteristics from the region

Images by way of: Cuyahoga State Home Reutilization Business Such treatment perform feel the added value of restoring qualities towards tax rolls. To help you throw the possibility increases when you look at the sharp save, imagine that twenty five,one hundred thousand abandoned attributes give through the 8 urban centers inside Kansas costs its municipalities more than “$forty two billion from inside the collective forgotten possessions taxation incomes.” twenty five New belongings bank’s demolition and rehabilitation things plus target the fresh problem of household flippers: speculators just who promote features inside the bad standing, in place of providing her or him around code, and thus proceeded new duration from abandonment and income tax standard. And their action-in-escrow program and you may strategic demolitions, the land bank reduces investors, means responsible residents manage home, and you may keeps house rehabilitations to proper conditions. 26

To that avoid, the newest CLB possess built staff software you to definitely instruct professionals into the enterprising enjoy for example estimating, you need to include give-toward learning drywall construction and you can build. twenty seven Brand new land-bank along with deals with institutions such as Koinonia Land, a social-service seller; its intellectually and you will developmentally disabled customers mow lawns and you will carry out most other similar repair. 28 By way of focus on a position opportunity, the newest land-bank does their goal of restoring house while also gaining people residents, plus recent immigrants, pros, while others.

Treatment and you will associated factors, as well as the time it takes to evaluate per property, signify brand new land-bank keeps regarding the 1,100000 to 1,five-hundred qualities at a time, each demanding maintenance pending demolition or recovery

CLB provides numerous independent resources of resource. At operational height, such provide is penalties and you may attention to the accumulated delinquent a property fees you to total $7 million annually. An important financing supply ‘s the property bank’s deed-in-escrow program, through which the newest land bank carries home to own re, and this produces on California laws for on line installment loans $step one.5 billion annually as a consequence of reasonable-cost conversion process, states you to customers rehabilitate their homes considering criteria lay by this new land-bank. Whenever you are renovations is actually underway, CLB holds the brand new deed to your domestic inside the escrow. As renovations try over, this new homebuyer will pay the newest escrow agent on domestic. Brand new land bank performs industrial lookup to have individual readers as some other supply of revenue. Likewise, CLB makes money on demolition. For instance, using good 2009 arrangement, Fannie mae sells empty, blighted residential property to your land-bank for $step one and will pay brand new land-bank at the very least $3,five-hundred for every single demolition. Regardless if offloading this type of homes having demolition looks in the beginning become good counterintuitive means, Frangos claims that performing this prevents the homes out of is a beneficial accountability getting Federal national mortgage association. Supplying the home so you’re able to CLB to have demolition – even in the event Federal national mortgage association is useful exercise – saves Federal national mortgage association money it would or even invest in taxes, servicing, and judicial measures for the houses court and you may eliminates the danger of arson and other dilemmas. Ultimately, CLB and additionally brings up money from the providing securities, thoughts on, while making funds, and you may credit loans. 30