Content

They can be bought and sold in NFT marketplaces like OpenSea, Rarible, Foundation, and Decentraland. We can differentiate them from Initial Exchange Offering tokens, which are normal Initial Coin Offering tokens offered through a crypto exchange promotion. In contrast to U.S. dollars, cryptocurrency ownership is usually recorded on a blockchain that uses a few vital components.

Only with some proof and stuff that is not readily available with a common google or way back search. Achieve fast, low-latency transactions with guaranteed finality in seconds, not minutes or hours. Hedera is an order of magnitude faster than blockchain alternatives.

List Of Dead Crypto Coins

Launched in 2017 through an ICO, Binance Coin is the native token of the BNB Chain ecosystem. Users that hold BNB on the Binance exchange are given a discount on trading fees. Within the last year, BNB’s stellar performance gave its early investors a whopping 1,300% return, causing its popularity to rise quickly as it became one of the crypto market’s favorite coins.

The Hedera proof-of-stake public network, powered by hashgraph consensus, achieves the highest-grade of security possible , with blazing-fast transaction speeds and incredibly low bandwidth consumption. By combining high-throughput, low fees, and finality in seconds, Hedera leads the way for the future of public ledgers. Now you know almost everything you need to know about different types of cryptocurrency existing out there!

If you are a developer of one of the coins or and have a issue, just contact us below. It is easy to hate, but this has been a very hard list to make and to try be fair with the listings of coins. Dead Coins list, cause of death, founders, project dates, screenshots, definitions and more… Those “farmed” tokens or tokens produced on top of those platforms are DeFi tokens that include but are not limited toChainlink ,Uniswap , Aave ,Dai ,and more.

In the beginning, Bitcoin was the only cryptocurrency, but later, other projects started to emerge. All of them and many others were born out of their native platforms, native blockchains, and all of them were slightly different from the Bitcoin blockchain. Also known as virtual currency or digital currency, cryptocurrency is often recognized as a medium of exchange for transactional purposes. The stablecoin has become one of the leading cryptocurrency assets by deposited amount on different DeFi platforms.

Consensus Service

While talking about multiple cryptocurrencies existing in the market, there are nearly 5,000 different coins out there. When cryptocurrency is more widely adopted by the mainstream, there’ll be even more altcoins and tokens. Ultimately, understanding these fundamentals will be great to help me deciphers a better choice for your future investments.

That means they’re flexible to be integrated for many purposes, and can function as other type of tokens as well. A common example is that utility tokens are also governance tokens. There are more and more decentralized protocols that boast on-chain governance that allows governance token holders to influence a decision through the in-place voting systems.

Simultaneously, all the other types of crypto coins are popularly styled now asaltcoinsoralternativecoins. Such a setup extends the capability of cryptocurrency beyond just regular money, as you’ll see in the case of crypto tokens. But more importantly, being the first currency built differently, Bitcoin started a big decentralization trend where governments and traditional banks no longer have a say in your privacy. So, if you’re curious about what’s next after Bitcoin, read on as we dissect the different types of cryptocurrency. Perhaps, you’ll also find some insights to diversify your investment portfolio. Any unknown information sent to us on the dead cryptocurrencies could have a bounty up to 0.01 ETH, things like linked projects and developers.

Elon Musk, the founder of Tesla, has also previously accepted Bitcoin as a form of payment for their electric vehicles, with plans to do so once again. These cryptocurrencies incorporate different methods of ensuring transaction privacy, e.g. coin mixing, anonymity techniques like CoinJoin, and offline transactions. This is in addition to techniques employed in mainstream crypto e.g. lack of tying real-world names with crypto addresses and blockchain encryption. There are also other less popular stablecoins such as euro stable coins, gold-backed coins, and other precious metals, oil, and commodity-backed tokens. The digital signature is created such that it cannot be exchanged for another.

Exchange Tokens

According to Tether, all of their tokens are 100% backed by their reserves including traditional fiat currencies and cash with other assets and receivables from loans made by Tether to third parties. Tether, widely known as USDT, is astablecointhat mirrors the price of the U.S. dollar. It has a stable value because it’s pegged to the USD and removes the volatility from the equation. As the name suggests, privacy coins are cryptocurrencies used for privacy applications because their code encourages better privacy than would Bitcoin and mainstream crypto. Approximately three years ago, ICO made its appearance, and it took off. Crypto projects, sometimes of questionable provenance, were looking to raise money, and for that, often created a new coin as a way to fundraise.

Tokenization allows for secure and verifiable ownership to create more efficient markets. Mint scalable tokens with low, predictable fees using Hedera Token Service. Five years ago, Bitcoin was merely seen as an investment for retail investors to profit from the exchange rate. This time, major institutional investors such as multimillion intelligence company – MicroStrategy, has join the market, buying over$1 billion worth of Bitcoinpurchases in 2020.

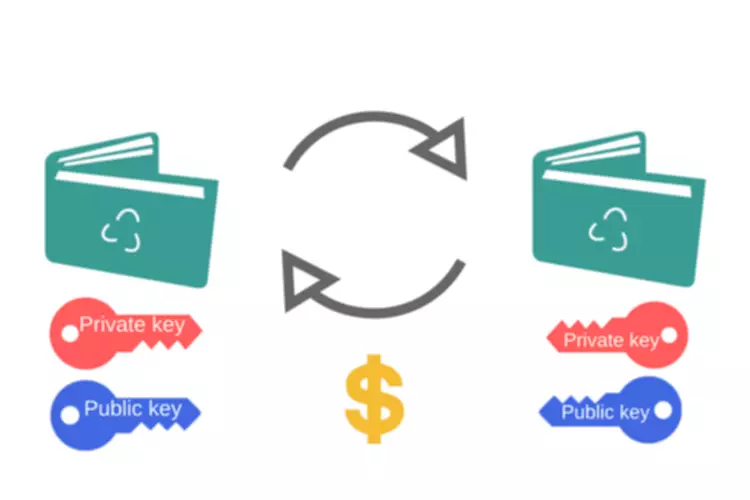

These balances of Bitcoin tokens are subsequently kept usingpublic and private keysto decrypt the encryption. To put it in simpler understanding, the public key is like your bank account number for you to send or receive bitcoin. In comparison, the private key is a secret key for you to authorize a bitcoin transmission. Non-fungible tokens are digital certificate of ownership to a unique asset on the blockchain. Also known as a security token, this type of token could be the next big thing in crypto as soon as regulators worldwide decide how to regulate it. Real World Asset tokens are responsible for real world asset going through “tokenization” – the process that helps turn real-world assets, such as real estate, into digital tokens.

Total Number Of Accounts Created On The Network

Ultimately, the utility coin is to boost the development and the ecosystem of the platform. Whatdefines DeFiis its aim to steer away from the traditional crypto platforms. The DeFi projects aim to enable users to borrow and lend within a peer-to-peer network, leverage the loans, and “farm” tokens for simply being Cryptocurrencies VS Tokens differences active. These tokens are value-adding because users can use them to pay fees, buy and sell other cryptocurrencies or power certain operations such as community voting for new coin listings. There are no physical bitcoins, but only the balances kept on a decentralized public ledger system, known as a blockchain.

And they reward users of their platforms with Web3 crypto tokens for contributing to the development of the other trend. Any interested investors can buy into the offering and receive a new crypto token issued by the company as an exchange. Through the fundraising campaign, companies will accumulate enough funds to keep the development process. Mainly because they are easier to exchange for other currencies, and the market liquidity is usually higher. To put it simply, they were made to compete with Bitcoin by changing the rules to appeal to different users. And although some of them do challenge Bitcoin after all these years, ironically, the good old 10-year-old grandpa stillheavily dominates the market.

- Tokenization allows for secure and verifiable ownership to create more efficient markets.

- In the beginning, Bitcoin was the only cryptocurrency, but later, other projects started to emerge.

- On a global scale, the annualized carbon footprint of Bitcoinequalsthe carbon footprint of New Zealand, 36.95 Mt CO2.

- The stablecoin has become one of the leading cryptocurrency assets by deposited amount on different DeFi platforms.

- Mint scalable tokens with low, predictable fees using Hedera Token Service.

- But, what if I tell you that there are many other types of cryptocurrency out there?

That means, if you hold AAVE, you have a say to favour or vote against the proposed changes or an upcoming proposal. Take Binance for an example; it still belongs to a group of people that contradicts Satoshi’s vision. https://xcritical.com/ This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Supply Chain

Hedera is the most used enterprise-grade public network for you to make your digital world exactly as it should be – yours. HBAR is the native, energy-efficient cryptocurrency of Hedera that powers the decentralized economy. Whether you’re a startup or enterprise, a creator or consumer, Hedera goes beyond blockchain for developers to create the next era of fast, fair, and secure applications.

Hedera Is Owned And Governed By The World’s Leading Organizations

Time for a transaction to reach finality once submitted to the network. Number of transactions processed by the network in the 24 hours prior to last metrics update. Once the merge is successful, ETH will be able to host even moreDeFi projects and it will be hard to imagine anyone who can challenge Ethereum’s founder, Vitalik Buterin, on his road to market dominance. On a global scale, the annualized carbon footprint of Bitcoinequalsthe carbon footprint of New Zealand, 36.95 Mt CO2. That is all because the Proof-of-Work consensus forces Ethereum to deal with the scalability issues.

No worries, you’ll find some practical examples later in the article. For now, just understand that crypto tokens don’t necessarily have their native blockchains and can be easily developed on top of other platforms. Compared to crypto coins that play a currency’s role, tokens often serve a particular function like voting for changes or rewarding people for participating in the network. As a cryptocurrency, Bitcoin is accepted as a means of payment for products sold or services provided that works just like fiat currency. Although it’s decentralized, the most intriguing part of bitcoin is its competitive exchange rate against the dollar attracting potential investors and traders. Despite it not being legally tendered, Bitcoin remains a popular type of cryptocurrency and has inspired many creators to launch their cryptocurrencies, collectively referred to as altcoins.

Unlike security tokens, utility tokens are not a direct investment but rather sustain the platform’s economy through the service provided. Bitcoin pioneered decentralized infrastructure and Ethereum brought programmability. But earlier proof-of-work blockchains consume massive amounts of energy and process transactions slowly in order to achieve acceptable levels of security. Heavy bandwidth consumption by these technologies leads to expensive fees, even for a simple cryptocurrency transaction. Best NFTs are those where only one person or a few can own an original. It helps artists, creators, and collectors, mainly, to sell their items.

Web3 tokens will aim to bring a fairer internet standard to everyone. Say, as an investment, you want to purchase a fraction of an apartment in New York, but not a whole apartment because it’s too expensive. Governance tokens are used for the purpose of making decisions that will dictate or govern a protocol’s future.

Record immutable, verifiable, and fairly ordered event logs for any application or permissioned blockchain framework. Track assets on a supply chain, IP rights, or identity credentials. Connect to Hedera in the languages you know best like JavaScript, Java, and Go to launch fast, fair, and secure applications on the decentralized network. Despite the recent crash in the crypto markets, its performance has been quite impressive.

Security tokens have been a buzzword for quite some time now, but it takes a good deal of proper regulation and standardization to put them to use. Hence the tokens below can all be considered ERC20 as long as they are launched on the Ethereum platform. Below we will explore different categories of tokens, and some tokens can be in more than one category as well. Create a Hedera mainnet account through a growing list of hbar supported wallets. Based on the cost of $0.0001 USD for Consensus-Submit-Message and Crypto-Transfer transactions.

In 2018, Circle announced the release of a fiat-backed stablecoin called USD Coin. Similar to USDT, USDC is a stablecoin pegged to the US dollar and backed by US dollars held in reserve. Their explosive growth came amidst the conditions of the coronavirus pandemic, when people started using it as a hedge against the fiat currencies. The development of the DeFi sector also helped to drive a massive amount of traffic to USDC.